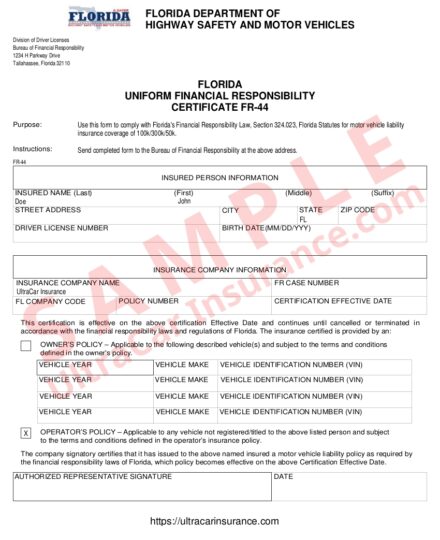

After a DUI/DWI license suspension, part of the reinstatement process includes filing a Florida FR44 insurance certificate with the state. FR44 insurance is also called Florida DUI insurance.

UltraCar Insurance helps you by surveying top-rated insurance companies to find the best rate and policy to suit your needs. Determining all the ins and outs of obtaining Florida FR44 insurance can be confusing. Our licensed agents can guide you through the process and complete an electronic filing of your FR44 certificate within 20 minutes.

What is FR44 insurance?

What’s the difference between SR22 and FR44 insurance? SR22 insurance in Florida is for non-alcohol-related traffic offenses. FR44 insurance is for DUI/DWI offenses. You’ll want to keep your FR44 certificate in good standing without lapse to avoid another license suspension. Initially and at renewal, you’ll have to pay your FR44 premium in full for six months.

How much does Florida DUI insurance cost?

Factors like age, gender, marital status, claims history, driving record, and where you reside determine your auto insurance rate. Florida’s already high premiums for standard auto insurance will likely double when you have an FR44 requirement.

The minimum auto insurance coverage required of all Florida drivers is $10,000 no-fault or personal injury protection (PIP) and $10,000 property damage liability (PDL). After a DUI conviction, the state requires you to carry insurance with much higher liability coverage. Therefore, you can expect significantly higher premiums. Minimum coverage requirements for Florida FR44 insurance increase as follows:

- $100,000 bodily injury per individual per accident

- $300,000 bodily injury per accident

- $50,000 property damage per accident

Other expenses associated with a DUI conviction include fines, fees, and the cost of installing a Florida ignition interlock device if required.

Owner and non-owner FR44 certificates

Do you need Florida FR44 insurance but don’t own a vehicle? You can fulfill your FR44 requirement with a non-owner’s insurance certificate. A non-owner FR44 offers secondary liability insurance coverage if you drive a car you don’t own. See our Florida Non Owner FR44 page for more information. You can also obtain FR44 motorcycle insurance or a commercial auto insurance policy with an FR44 endorsement.

What if you move to another state?

Florida owner and non-owner FR44 policies always have six-month terms. Most people must maintain this insurance for three years, even if they move to another state. No other state, except Florida and Virginia, issues FR44 certificates. And no insurance company can issue or process an out-of-state FR44 filing.

So, what happens to your FR44 if you move out of state? You should contact your insurance provider for advice before you move. If you stop paying your Florida FR44 insurance premiums, you’ll likely experience problems getting a driver’s license, auto registration, or insurance in your new state.

Florida Highway Safety and Motor Vehicles (FLHSMV)

Details regarding Florida DUI and administrative suspension laws are on the Florida HSMV website.

Call UltraCar Insurance for a fast FR44 quote at an affordable rate. We compare rates and policies from several insurance companies to maximize your savings. Get a quote online now or call us today!

We partner with Intoxalock® to SAVE YOU MONEY on an ignition interlock installation!

NOTE: If you need SR22 insurance for a non-DUI-related violation, see Florida SR22 Insurance.