When you need affordable Oregon SR22 insurance, UltraCar Insurance surveys top-rated insurance companies to offer you the lowest rates. We can obtain and file your SR22 certificate same day, so you can reinstate your license and get back on the road.

What is Oregon SR22 Insurance?

Oregon requires drivers to carry specific minimum liability insurance coverage when operating a vehicle. You can add more options, but the minimum coverage requirements are:

- $25,000 bodily injury per accident

- $50,000 bodily injury liability for all injuries in an accident

- $20,000 in property damage per accident

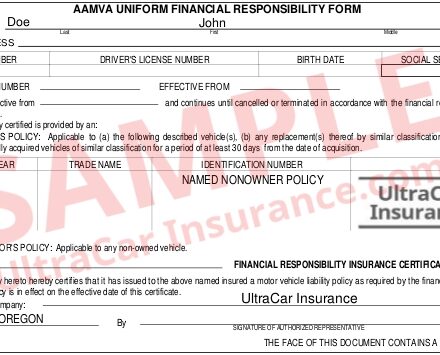

If you own a vehicle, the certificate of financial responsibility is an endorsement to your auto insurance policy. If you don’t own a car, the certificate is an endorsement to a non-owner insurance policy. The state DMV restores your driving privileges when we file your certificate. An SR22 filing is a guarantee of insurance coverage. Therefore, the company that issued your SR22 policy monitors it closely to ensure you maintain it for the assigned time period. If you allow your policy to lapse or cancel it, the insurance company notifies the DMV by filing an SR26 form. The SR26 filing cancels your SR22 because you no longer carry insurance. The state then suspends your license again.

Two types of Oregon SR22 insurance are available: SR22 owner insurance and SR22 non owner insurance. Owner/owner-operator policies are for drivers who own a vehicle. Non-owner policy is for those who don’t own a car, and it covers you when driving a borrowed vehicle. (See our Oregon Non Owner SR22 Insurance page if you do not own a vehicle.)

Oregon DMV

You’ll find many informative links on the Oregon DMV website concerning license suspensions and reinstatement procedures.

UltraCar Insurance in Oregon

Experience the best in Oregon SR22 insurance service with UltraCar Insurance. Start an online quote or call us for low-cost SR22 quotes today!