UltraCar Insurance makes obtaining Arizona SR22 insurance simple. This high-risk certificate can often be costly, so we survey top-rated insurance companies to ensure you get the best price for the insurance you need. You can get SR22 insurance whether you own a vehicle or not. We can file your certificate in as little as 20 minutes, and you’ll be on your way to having your driving privileges back!

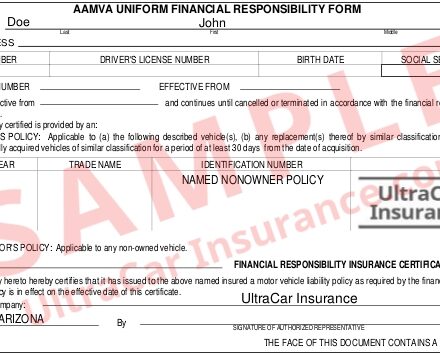

Arizona requires all vehicle owners to insure their vehicles with minimum liability insurance coverage. If the state has suspended or revoked your driver’s license, you must buy Arizona SR22 insurance to reinstate it. Vehicle owners endorse the SR22 certificate to their auto insurance policy. When you don’t own a vehicle but occasionally borrow one, the certificate attaches to a nonowner insurance policy. Nonowner insurance is secondary to a vehicle owner’s auto insurance coverage.

Minimum auto liability coverage required in Arizona

- $15,000 bodily injury per accident

- $30,000 bodily injury liability for all injuries in an accident

- $10,000 in property damage in one accident

What is Arizona SR22 Insurance?

If you own a registered vehicle, your insurance provider attaches the SR22 certificate to your auto insurance policy and files it on your behalf with the Arizona Department of Transportation. This is the final step to reinstate your driver’s license. You must maintain the insurance policy that guarantees the certificate filing for three years. If the policy lapses or expires during this time, the insurance company informs the Arizona Department of Transportation, which results in another license suspension.

Can you get high-risk auto insurance if you don’t own a car?

You can reinstate your license by filing a nonowner SR22 certificate when you don’t own a vehicle. If you borrow someone’s vehicle on occasion, non owner SR22 insurance Arizona insures you as a driver. In an at-fault accident, it acts as secondary insurance to cover claims that exceed the vehicle owner’s primary insurance coverage.

Arizona DOT

Get more information on the Arizona Department of Transportation (ADOT) website:

UltraCar Insurance in Arizona

Scroll down to see more articles about Arizona SR22 insurance. UltraCar Insurance will find the best SR22 rate for vehicle owners or nonowners. Please call us to discuss any questions or concerns, or click the quote button today!