Colorado SR22 insurance is premium insurance for high-risk drivers, so finding the best rate is essential. When you need SR22 insurance to reinstate your driver’s license, count on UltraCar Insurance for low rates and quick submission of your SR22 filing. We work on your behalf, surveying top rated companies for the best owner and non owner SR22 insurance rates. In most cases we can issue and file your SR22 certificate with the state within 20 minutes.

Colorado minimum liability insurance requirements:

- $25,000 bodily injury for one person in one accident

- $50,000 for two or more persons in one accident

- $15,000 property damage incurred in one accident

What is Colorado SR22 Insurance?

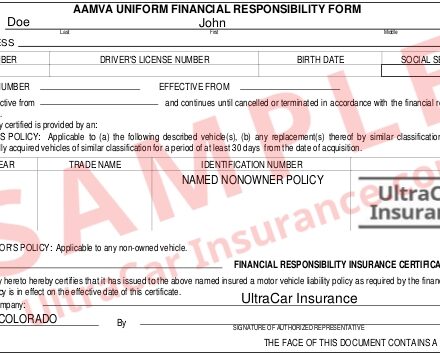

Colorado SR22 Insurance is high-risk insurance that’s required for driver’s license reinstatement. There are two types of SR22 Colorado insurance: owner and non owner. Colorado SR22 owner insurance is financial responsibility form (certificate) that’s attached to a driver’s primary auto insurance policy. It is for drivers who have a vehicle registered in their name and want to have their license reinstated.

Drivers who do not own a vehicle, but wish to reinstate their suspended or revoked license will need a Colorado SR22 non owner insurance policy. Colorado non owner SR22 insurance is filed in the same way as owner SR22 insurance, but it is a liability-only policy that covers the policyholder when they drive a non owned vehicle on an occasional basis. A non owner SR22 policy acts as secondary insurance to the vehicle owner’s primary insurance. It does not cover household vehicles, rental or commercial vehicles. Non Owner SR22 vs SR22 Insurance explains the difference between these types of SR22 insurance.

How long do I need to keep high-risk insurance?

Drivers need to carry Colorado SR22 insurance without lapse for one to three years. When you buy SR22 insurance, insurance provider issues and files the certificate with the Colorado Department of Revenue (DOR) Driver Services. If you fail to keep this policy in force the entire time, your agent must submit an SR26 filing to the DMV, which results in another license suspension. This is a costly mistake that can result in additional fines up to $500.00 or even jail time.

Colorado Broad Form Insurance

Another auto insurance option available in Colorado is Broad Form Insurance. This type of insurance offers very cheap rates, but with VERY minimal liability coverage. Broad form insurance (named driver insurance) covers only you as the owner-operator of one or multiple vehicles. If you don’t own a vehicle, you can get a non-owner broad form insurance policy. For the purpose of license reinstatement, an insurance provider can attach an SR22 insurance certificate to a Colorado broad form policy. To learn more about the strict coverage limitations of type of policy, see Broad Form Vehicle Insurance and What is Broad Form SR22 Insurance?

Colorado DOR

The Colorado Department of Revenue website (Driver Services) has answers to many frequently asked questions about license reinstatement.

UltraCar Insurance in Colorado

Whether you need owner or non owner Colorado SR22 insurance, you can count on UltraCar Insurance to find the best rate possible. As soon as we receive your online or phone request, we begin surveying several insurance companies to find the best rate for you. Start your quote now or give us a call today!