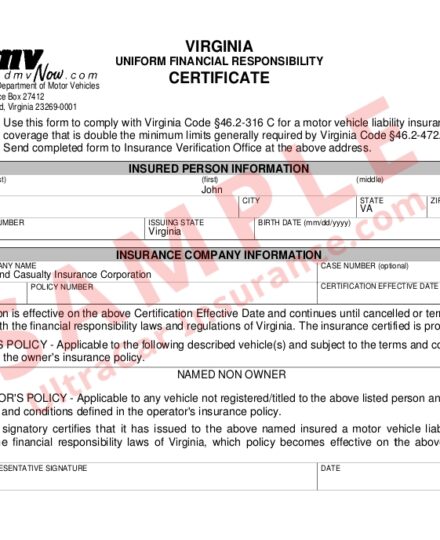

UltraCar Insurance provides some of the industry’s most competitive Virginia SR22 FR44 insurance rates tailored to your situation. We’ll write your policy and file your certificate with the Virginia Department of Motor Vehicles (DMV) in as little as 20 minutes.

What is Virginia SR22 FR44 insurance?

To reinstate your driving privileges after license suspension, you’ll need Virginia SR22 FR44 insurance. What’s the difference between SR22 and FR44 insurance? To reinstate your license after non-alcohol or drug-related license suspensions, you’ll buy SR22 insurance in Virginia. If your license suspension is for a DUI conviction, you’ll get Virginia FR44 insurance.

Vehicle owners need an owner/owner-operator policy. People who don’t own a car, truck, or motorcycle must buy Non-Owner SR22 Insurance Virginia or Non-Owner FR44 Virginia. Your insurance provider attaches the certificate to your policy and then files it with the DMV. After completing the filing process, you must maintain your policy for 3 to 5 years. During that time, an insurance underwriter monitors your policy to ensure it stays current. If it lapses, the insurance company notifies your insurance provider, who files an SR26 for FR46 form with the DMV. This filing tells the state that you’re no longer insured, resulting in another license suspension.

Minimum Virginia SR22 FR44 Coverage Requirements

SR22 insurance minimum coverage

- $50,000 bodily injury per person

- $100,000 bodily injury liability for all injuries in an accident

- $25,000 property damage per accident

FR44 insurance minimum coverage *

- $100,000 bodily injury per person

- $200,000 bodily injury liability for all injuries in an accident

- $50,000 property damage per accident

* Virginia FR44 coverage requirements are higher than SR22; thus, the premiums are also higher.

Virginia uninsured motorist minimum coverage (Required for SR22 & FR44 policies)

- $50,000 per person / $100,000 per accident bodily injury

- $25,000 uninsured property damage per accident

Virginia DMV

Get more information about Driver’s License Reinstatement on the Virginia DMV website.

Related Information about High-Risk Auto Insurance

- Intoxalock® Ignition Interlock services

- What is FR44?

- FR44 Non-Owner Insurance

- SR22 DUI Insurance

- Non Owner SR22 vs. SR22 Insurance

- How to get lower insurance rates

- How SR22 insurance costs are determined

UltraCar Insurance in Virginia

Experience the best in Virginia SR22 FR44 insurance service with UltraCar Insurance. Talk with one of our licensed, friendly agents – or start an online quote today!