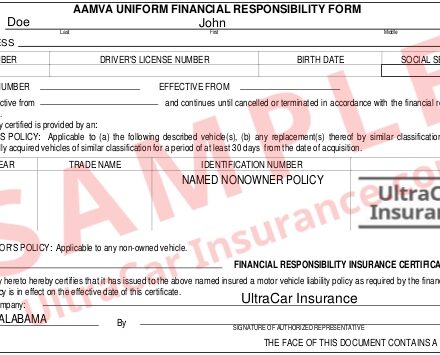

When you need Alabama SR22 insurance to reinstate your driver’s license, you want a company that works on your behalf. UltraCar Insurance completes your SR22 certificate filing in as little as 20 minutes, start to finish. We write strictly with top rated insurance companies to find the best policy and rate for your needs. Whether you need an owner or non owner policy, we hope you’ll choose us as your SR22 insurance provider.

What is Alabama SR22 Insurance?

Reasons for SR22 insurance are varied. After a license suspension, you’ll have to purchase Alabama SR22 insurance to reinstate your driving privileges for a specific period of time. Usually, you’ll have to carry this insurance for three to five years. You must maintain it during that time, or your the state will suspend your license again.

If you own a vehicle, the SR22 financial responsibility form is an endorsement to your auto insurance policy, and your insurance provider files it with the Alabama DOR Motor Vehicle Division.

Alabama SR22 non owner insurance is for people who don’t own a vehicle, but who occasionally borrow a vehicle to drive. In this case, your agent writes a non-owner policy and endorses the SR22 certificate to that policy. Non owner insurance is secondary liability coverage, meaning that it covers claims that exceed a vehicle owner’s primary insurance coverage.

Alabama DOR & ALEA

The Alabama Mandatory Liability Insurance Law requires all Alabama drivers to carry minimum liability insurance coverage:

- $25,000 for property damage in an accident

- $50,000 bodily injury liability for all injuries in an accident

- $25,000 bodily injury for one person injured in an accident

See the Alabama Law Enforcement Agency (ALEA) Driver License Department for additional information.

More information about Alabama SR22

Continue scrolling down this page for other articles about Alabama SR22 insurance. The following articles are also related to this topic:

- Non Owner SR22 vs SR22 Insurance

- How SR22 costs are determined

- Can you buy SR22 insurance without a vehicle?

- SR22 Motorcycle Insurance

UltraCar Insurance in Alabama

UltraCar Insurance compares the rates of several top companies. In this way we can offer low Alabama SR22 insurance rates that maximize your savings. All of our agents hold Alabama insurance licenses. For affordable SR22 quotes, click the orange button or call us today!