Every Arkansas driver must carry minimum liability insurance. When you have certain motor vehicle offenses on your driving record resulting in a suspended license, the state will require you to add an SR22 form to your insurance policy. Arkansas SR22 insurance is a certificate of financial responsibility the state requires in order to reinstate a suspended license. Let UltraCar Insurance help find you the right high-risk insurance solution with quotes in as little as 20 minutes.

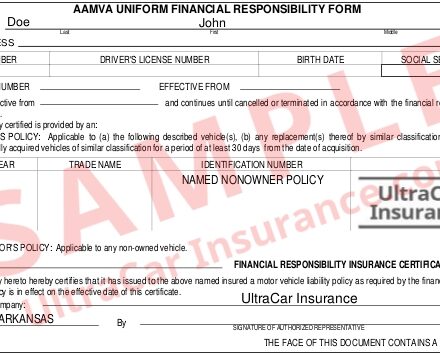

Arkansas SR22 insurance is a certificate of financial responsibility you file with the Arkansas Department of Motor Vehicles. The certificate is an endorsement to an auto or non-owner policy, and filing it allows you to reinstate your driver’s license. The state requires Arkansas drivers with suspended licenses to carry this insurance for a certain time. An SR22 certificate is a rider or endorsement to a policy holder’s auto or non-owner insurance. The driver’s insurance company monitors the SR22 policy to guarantee that the driver has adequate liability insurance during a mandated time period.

In most cases, drivers must carry SR22 insurance without interruption for three years in most cases. During this time, it is extremely important not to allow the insurance to lapse or expire. If it does, the insurance company notifies the Arkansas DMV by filing an SR26 form. This results in another license suspension or revocation.

Arkansas SR22 Insurance and Non Owner Insurance

There are two types of Arkansas SR22 insurance. Drivers who own a vehicle and want to reinstate their license must buy owner SR22 insurance. Those who do not own a vehicle must get non-owner SR22 insurance to drive a vehicle owned by another person.

The state of Arkansas requires licensed drivers to carry minimum liability insurance coverage. Listed below are the minimum coverage requirements, but drivers can purchase higher amounts if they wish.

- $25,000 property damage incurred in one accident

- $50,000 for two or more individuals in one accident

- $25,000 bodily injury for one individual in one accident

Arkansas DMV

You can find more information about licensing, motor vehicle laws and penalties on the Arkansas DFA website.

UltraCar Insurance in Arkansas

UltraCar Insurance will find the best Arkansas SR22 insurance rate for you, and never any filing fees. Please call with questions, and get fast quotes and accurate filings for license reinstatement.