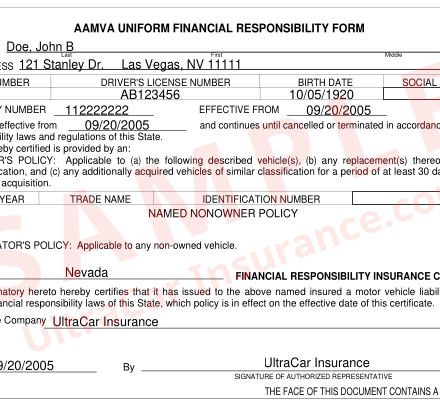

What is SR22 insurance? You may have never heard of the term unless circumstances led to your driver’s license suspension. SR-22 is also called the AAMVA Uniform Financial Responsibility Form. It’s a document that an insurance provider, licensed in your state, submits to the DMV to reinstate your license.

NOTE: Florida and Virginia require an SR22 certificate for non-alcohol or drug-related violations and another type of certificate (FR44) for DUI/DWI violations.

What does SR22 insurance do?

Every state requires licensed drivers with a registered vehicle to carry liability insurance. These auto insurance policies must have a minimum coverage for bodily injury and property damage. Why does your state require liability insurance? Because every driver is responsible for injury or property damage if they cause an accident. That is the principle of financial responsibility.

After a license suspension, the state wants a guarantee that the high-risk driver will have liability coverage in exchange for license reinstatement. SR22 insurance provides that guarantee or proof of financial responsibility.

Don’t let your SR22 policy lapse.

In most cases, your state will require you to keep SR22 insurance in force for 1-3 years after license reinstatement. The insurance underwriter monitors your SR22 insurance policy. If the policy lapses, they immediately submit an SR26 form to the state DMV, resulting in repeat license suspension.

Let UltraCar Insurance know if you anticipate having late SR22 payments during the pandemic. We’ll help you contact your insurance carrier to discuss a payment plan.

Owner and Non-Owner SR22 Insurance

Owner/Owner-Operator Insurance Policies

There are two types of SR22 insurance for license reinstatement. People who own a registered vehicle require an owner/owner-operator policy. You can even get SR22 motorcycle insurance in most states.

What happens if you sell your car before your requirement has ended? A common misconception is that you can stop paying for your SR22 policy if you sell your vehicle. But this is not true. You must still maintain SR22 insurance until the state no longer requires it. Therefore, to comply with this requirement, contact your provider to convert to a Non-Owner SR22 policy before selling your car.

Non-Owner Insurance Policies

Can you buy SR22 insurance without a vehicle? Yes! You’ll need a non-owner policy with an SR22 endorsement if you don’t own a car.

Reasons for SR22 insurance

Uninsured Driving

Several circumstances can lead to your having to carry high-risk insurance. Driving without insurance is one of the most common reasons for license suspension. It not only puts you and your passengers at risk, but it also puts other people at risk. Besides getting a ticket for this, you can end up with a license suspension. You’ll have a probationary suspension period between 30 to 90 days, assuming no additional violations occurred. So, it’s crucial to ensure your auto insurance is always current.

What if you don’t own a car? If you’re driving a borrowed vehicle and an officer pulls you over, you can get a ticket if the owner doesn’t carry insurance. Always answer two questions before driving anyone’s car: 1. Do you have auto insurance? 2. Is there a valid insurance ID card in the glove compartment?

Legal Judgments or Other Traffic Violations

- Court-ordered child support or other legal judgment

- Accumulating too many points (tickets) on your driving record

- A DUI or DWI conviction

- Driving with a suspended license

- Uninsured at-fault accident

Can I cancel my high-risk insurance if I move to another state?

If your state requires you to carry high-risk auto insurance and you move to another state, don’t stop making your payments. Even if you move, this requirement remains in effect. Other states honor this insurance requirement of your state. Before moving out of state, contact your agent with your new address to stay in compliance with your high-risk insurance requirement.

Call UltraCar Insurance to answer your question, “What is SR22 insurance?” Our agents are licensed in 34 states and offer low-cost SR22 quotes to individuals and businesses. Call us for a no-obligation consultation, complete our contact form, or start an online quote today!