California SR22 insurance is liability-only insurance the state requires you to carry as a condition for license reinstatement after a suspension. When you need SR22 insurance, select a company that will work quickly for you on your behalf. UltraCar Insurance offers friendly service and low rates for SR22 policies. We offer fast electronic filing of your certificate with the California State Department of Motor Vehicles – in as little as 20 minutes from start to finish. After we submit your filing to the DMV, processing is usually complete within 24-36 hours.

What is California SR22 Insurance?

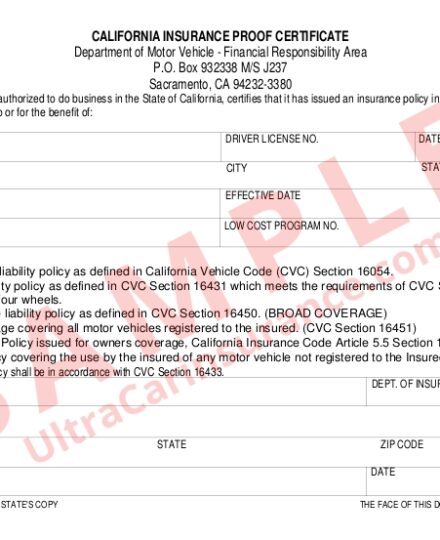

SR22 insurance in California is a financial responsibility certificate attached to a vehicle owner’s primary insurance policy and filed with California State DMV. It’s high-risk auto liability insurance that the state requires you to carry to reinstate your driver’s license. The state will determine how long an individual must carry California SR22 insurance insurance, but typically, it’s for one to three years. During this time, your insurance provider monitors the policy. If you miss a payment or stop paying your premiums, your insurance provider will alert the DMV by filing an SR26 form. The DMV will immediately suspend your license upon the SR26 notification.

Another type of California SR22 insurance is available for non-vehicle owners. California non-owner SR22 insurance is a policy for one driver, not a vehicle. It is for people who do not own a car but want to reinstate their driver’s license. Non-owner insurance covers the policyholder if they occasionally drive another person’s vehicle. The non-owner certificate is liability insurance secondary to a vehicle owner’s primary insurance coverage. It becomes effective if the policyholder causes an at-fault accident. It covers claims if they exceed the vehicle owner’s primary insurance coverage. Non-owner policies do not apply to rental, commercial, or household vehicles.

Minimum Auto Insurance Coverage in California

All registered vehicles driven in the State of California must have minimum liability insurance coverage of:

- $30,000 bodily injury per accident

- $60,000 bodily injury liability for all injuries in an accident

- $15,000 in property damage in one accident

California< DMV

The California DMV website provides more information about licensing, motor vehicle laws, and penalties for moving violations.

UltraCar Insurance in California

Scroll down to see more helpful articles about California SR22. UltraCar Insurance prioritizes total customer satisfaction. Let us address all your concerns and answer your questions. Give us a call or start an online quote today!