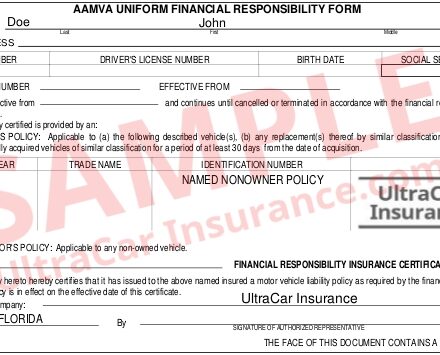

If you have a suspended license, the process of driver’s license reinstatement includes buying a Florida SR22 insurance certificate. Whether you need an owner or non-owner SR22, UltraCar Insurance helps by finding the best rate and policy to suit your needs. We usually complete SR22 filings within 20 minutes.

What is Florida SR22 Insurance?

When you have a suspended license that’s not DUI-related, the state requires you to carry SR22 insurance to reinstate it. Three years is generally the amount of time people have to keep this insurance. During that time, you’ll have to keep your policy current, or the state will suspend your driving privileges again.

Non-owner insurance

Florida SR22 insurance is available if you own a vehicle, or if you don’t. If you’re not a vehicle owner, see Florida Non Owner SR22 Insurance for more information.

Minimum liability coverage requirements

SR22 insurance must have the following minimum coverage:

- $10,000 bodily injury per accident

- $20,000 bodily injury liability for all injuries in an accident

- $10,000 in property damage in one accident

Florida Highway Safety and Motor Vehicles (FLHSMV)

Get more information on the FLHSMV website regarding:

- Florida licensing, motor vehicle laws and penalties

- Florida license suspensions and revocations and license reinstatement

More Florida SR22 insurance information

Visit these articles on our website for information related to this article:

- Non Cancelable FR44 Florida

- Non Owner SR22 vs SR22 Insurance

- What’s the difference between SR22 and FR44 insurance?

UltraCar Insurance in Florida

UltraCar Insurance will quickly find you the lowest rate possible. We always maximize your savings by comparing rates from several insurance companies. Click the quote button to start your Florida SR22 insurance quote or call us today!

Do you need Florida FR44 insurance for a DUI-related license suspension? Visit our Florida FR44 Insurance page to learn more.